The price of polysilicon has fallen below 200 yuan/kg, and it is no doubt that it has entered a downward channel.

In March, the orders of module manufacturers were full, and the installed capacity of modules will still increase slightly in April, and the installed capacity will start to accelerate during the year.

As far as the industry chain is concerned, the shortage of high-purity quartz sand continues to intensify, and the price continues to rise, and the top is unpredictable. After the price reduction of silicon materials, leading silicon wafer and crucible companies are still the biggest beneficiaries of the photovoltaic industry chain this year.

Prices of silicon materials and silicon wafers continue to deviate simultaneous acceleration of bidding on the component side

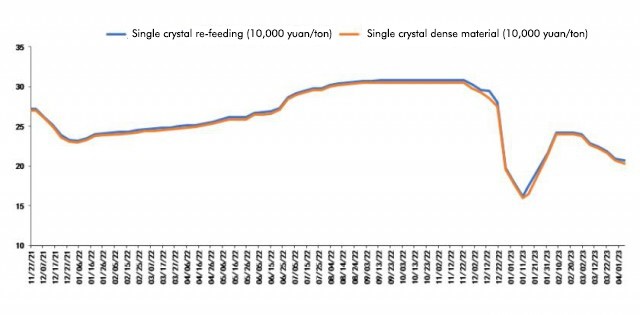

According to the latest quotation of polysilicon by Shanghai Nonferrous Network on April 6, the average price of polysilicon re-feeding is 206.5 yuan/kg; the average price of polysilicon dense material is 202.5 yuan/kg. This round of polysilicon material price decline began in early February, and has continued to decline since then. Today, the price of polysilicon dense material officially fell below the 200 yuan/ton mark for the first time.

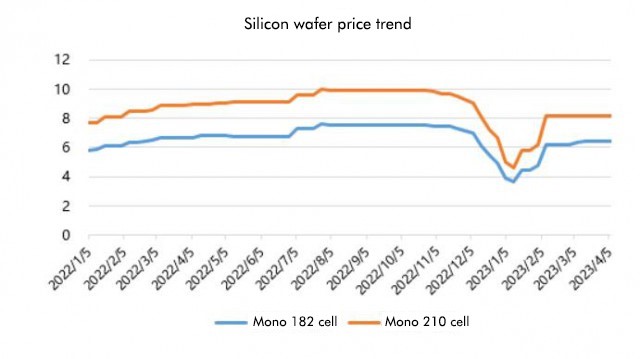

Looking at the situation of silicon wafers, the price of silicon wafers has not changed much recently, which is different from the price of silicon materials.

Looking at the situation of silicon wafers, the price of silicon wafers has not changed much recently, which is different from the price of silicon materials.

Today the Silicon Industry Branch announced the latest silicon wafer prices, of which the average price of 182mm/150μm is 6.4 yuan/piece, and the average price of 210mm/150μm is 8.2 yuan/piece, which is the same as last week’s quotation. The reason explained by the Silicon Industry Branch is that the supply of silicon wafers is tight, and in terms of demand, the growth rate of N-type batteries has slowed down due to problems in production line debugging.

Therefore, according to the latest quotation progress, silicon materials have officially entered the downward channel. The installed capacity data from January to February this year greatly exceeded expectations, with a year-on-year increase of 87.6%. In the traditional off-season of the first quarter, it was not slow. Not only was it not slow, it also hit a record high. It can be said that it has made a good start. Now that it has entered April, as the price of silicon materials continues to fall, downstream component shipments and terminal installations It also obviously started to accelerate.

On the component side, the domestic bidding in March was about 31.6GW, an increase of 2.5GW month-on-month. The cumulative bidding in the first three months was 63.2GW, a cumulative increase of about 30GW year-on-year. %, it is understood that the basic production capacity of leading companies has been fully utilized since March, and the production schedule of the four leading component companies, LONGi, JA Solar, Trina, and Jinko, will increase slightly.

On the component side, the domestic bidding in March was about 31.6GW, an increase of 2.5GW month-on-month. The cumulative bidding in the first three months was 63.2GW, a cumulative increase of about 30GW year-on-year. %, it is understood that the basic production capacity of leading companies has been fully utilized since March, and the production schedule of the four leading component companies, LONGi, JA Solar, Trina, and Jinko, will increase slightly.

Therefore, Jianzhi Research believes that basically so far, the trend of the industry is in line with predictions, and this time the price of silicon materials has fallen below 200 yuan/kg, which also means that its downward trend is unstoppable. Even if some companies hope to raise prices, It is also more difficult, because the inventory is also relatively large. In addition to the top polysilicon factories, there are also many late-entry players. Coupled with the expectation of large-scale expansion in the second half of the year, the downstream polysilicon factories may not accept it if they want to raise prices.

The profits released by silicon materials,Will it be eaten up by silicon wafers and crucibles?

In 2022, the new installed capacity of photovoltaics in China will be 87.41GW. It is estimated that the new installed capacity of photovoltaics in China will be optimistically estimated at 130GW this year, with a growth rate of nearly 50%.

Then, in the process of reducing the price of silicon materials and gradually releasing profits, how will the profits flow, and will they be completely eaten up by the silicon wafer and crucible?

Jianzhi Research believes that, unlike last year’s prediction that silicon materials will flow to modules and cells after the price cut, this year, with the continuous increase in the shortage of quartz sand, everyone has paid more attention to the silicon wafer link, so silicon wafers , Crucible, and high-purity quartz sand have become the core segments of the photovoltaic industry this year.

The shortage of high-purity quartz sand continues to intensify, so the price is also rising crazily. It has been said that the highest price has risen to 180,000/ton, but it is still rising, and it may rise to 240,000/ton by the end of April. Can’t stop.

Analogous to last year’s silicon material, when the price of quartz sand is rising wildly this year and there is no end in sight, there will naturally be a great driving force for silicon wafer and crucible companies to raise prices during the shortage period, so even if all of them are eaten up, profits will not be enough , but in the situation where the price of middle and inner layer sand continues to rise, the most benefited are still silicon wafers and crucibles

Of course, this must be structural. For example, with the price increase of high-purity sand and crucible for second- and third-tier silicon wafer companies, their non-silicon costs will rise sharply, making it difficult to compete with the top players.

However, in addition to silicon materials and silicon wafers, cells and modules in the main industry chain will also benefit from the price reduction of silicon materials, but the benefits may not be as great as previously expected.

For component companies, although the current price is about 1.7 yuan/W, it can fully promote the installation of domestic and foreign countries, and the cost will also decrease with the price reduction of silicon materials. However, it is difficult to say how high the price of high-purity quartz sand can rise. , so important profits will still be sucked away by the crucible and leading silicon wafer companies.

Post time: Apr-10-2023