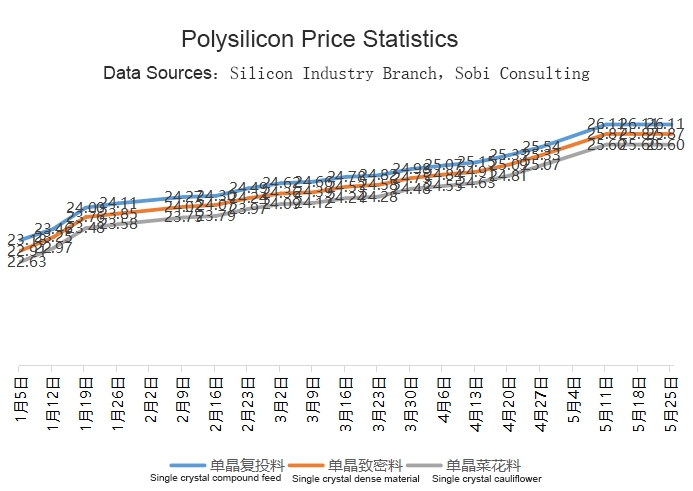

On May 25, the silicon branch of China Nonferrous Metals Industry Association announced the latest price of solar grade polysilicon.

data display

● the transaction price of single crystal re feeding is 255000-266000 yuan / ton, with an average of 261100 yuan / ton

● the transaction price of single crystal compact is RMB 25300-264000 / ton, with an average of RMB 258700 / ton

● the transaction price of single crystal cauliflower is 25000-261000 yuan / ton, with an average of 256000 yuan / ton

This is the second time this year that polysilicon prices are flat.

According to the data released by the silicon industry branch, the highest, lowest and average prices of all kinds of silicon materials are consistent with those of last week. It is revealed that polysilicon enterprises basically have no inventory or even negative inventory, and the output mainly meets the delivery of long orders, with only a few high priced loose orders.

In terms of supply and demand, according to the data previously released by the silicon industry branch, the polysilicon supply chain in June is expected to be 73000 tons (domestic output of 66000 tons and import of 7000 tons), while the demand is also about 73000 tons, maintaining a tight balance.

As this week is the last quotation in May, the price of long order in June is basically clear, with a month on month increase of about 2.1-2.2%.

After communicating with relevant enterprises, soby PV network believes that the price of large-size (210/182) silicon wafers may be flat or rise slightly due to the insignificant increase of silicon materials, while the price of 166 and other traditional size silicon wafers may rise more significantly after the inventory is consumed due to the reduction of production equipment (upgrading to 182 or asset impairment). When it is transmitted to the battery and module end, the large-scale increase is expected to be no more than 0.015 yuan /w, and there is great uncertainty in the prices of 166 and 158 batteries and modules.

From the recent component bid opening and bid winning prices, the component prices delivered in the third and fourth quarters may not be lower than those in the second quarter, which means that the component prices will remain high in the second half of the year. Even in the fourth quarter, when the silicon material production capacity is relatively abundant, it is difficult for the domestic component prices to drop significantly due to the impact of high price orders in the overseas market, centralized grid connection of large domestic projects and other factors.

Post time: May-30-2022